About Me

Hi, I'm Rita.

I'm a Mortgage Professional with broad experience in all aspects of the financing process - whether it be helping first-time buyers purchase their first home; assisting clients with financing for a renovation to their existing home; building a new home or helping them re-negotiate their mortgage at renewal.

My goal is to help my clients navigate through the process of finding the right financing product for their unique situation.

I specialize in mortgages for self-employed borrowers; borrowers with slightly bruised credit and first time home buyers, home equity Lines of Credit; first & second mortgages; mortgage renewals; re-finances and investment property mortgages.

Cell: 403-502-3330

STEP ONE

Start the conversation.

The best place to start is to connect with me directly. The mortgage process is personal, and it can be daunting. My commitment to you is that I'll listen to all your needs, assess your financial situation, and provide you with a plan to move forward.

STEP TWO

Choose the best option.

Once we’ve had a look at your financial situation, we’ll consider a variety of mortgage options, I’ll outline what documents are necessary to qualify for a mortgage, negotiate with the lenders on your behalf, and arrange the mortgage that best suits your needs.

STEP THREE

Sit back and relax.

Once we’ve arranged the mortgage product that best suits your needs, you’re not alone. I’m your mortgage professional for life. If you’ve got questions in the years to come, I’m always available to make sure that your mortgage is working for you, and not the other way around!

Lenders

I've developed excellent relationships with many lenders across the country.

Let's figure out which one has the best product for you.

Services

As a mortgage professional it's my job to be the go-between between you and a mortgage lender. I make sure that you know all the products available to you, and are equipped with the knowledge to make the best decisions for you and your family.

Flexible Mortgages

As your life can change at any time, I offer a wide range of flexible mortgage products.

Qualified Advice

As a licensed mortgage expert, I'll listen to your needs and answer your questions.

No Cost to You

There are no fees for my services, once you find the perfect product, the lender pays me a commission.

Advocacy

I commit to working on your behalf

to find you the best mortgage for your needs.

Mortgage Articles

Bank of Canada maintains policy rate at 2¼%. FOR IMMEDIATE RELEASE Media Relations Ottawa, Ontario January 28, 2026 The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%. The outlook for the global and Canadian economies is little changed relative to the projection in the October Monetary Policy Report (MPR). However, the outlook is vulnerable to unpredictable US trade policies and geopolitical risks. Economic growth in the United States continues to outpace expectations and is projected to remain solid, driven by AI-related investment and consumer spending. Tariffs are pushing up US inflation, although their effect is expected to fade gradually later this year. In the euro area, growth has been supported by activity in service sectors and will get additional support from fiscal policy. China’s GDP growth is expected to slow gradually, as weakening domestic demand offsets strength in exports. Overall, the Bank expects global growth to average about 3% over the projection horizon. Global financial conditions have remained accommodative overall. Recent weakness in the US dollar has pushed the Canadian dollar above 72 cents, roughly where it had been since the October MPR. Oil prices have been fluctuating in response to geopolitical events and, going forward, are assumed to be slightly below the levels in the October report. US trade restrictions and uncertainty continue to disrupt growth in Canada. After a strong third quarter, GDP growth in the fourth quarter likely stalled. Exports continue to be buffeted by US tariffs, while domestic demand appears to be picking up. Employment has risen in recent months. Still, the unemployment rate remains elevated at 6.8% and relatively few businesses say they plan to hire more workers. Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism. In the projection, consumer spending holds up and business investment strengthens gradually, with fiscal policy providing some support. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement. CPI inflation picked up in December to 2.4%, boosted by base-year effects linked to last winter’s GST/HST holiday. Excluding the effect of changes in taxes, inflation has been slowing since September. The Bank’s preferred measures of core inflation have eased from 3% in October to around 2½% in December. Inflation was 2.1% in 2025 and the Bank expects inflation to stay close to the 2% target over the projection period, with trade-related cost pressures offset by excess supply. Monetary policy is focused on keeping inflation close to the 2% target while helping the economy through this period of structural adjustment. Governing Council judges the current policy rate remains appropriate, conditional on the economy evolving broadly in line with the outlook we published today. However, uncertainty is heightened and we are monitoring risks closely. If the outlook changes, we are prepared to respond. The Bank is committed to ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. Information note The next scheduled date for announcing the overnight rate target is March 18, 2026. The Bank’s next MPR will be released on April 29, 2026. Read the January 28th, 2026 Monetary Report

Ready to Buy Your First Home? Here’s How to Know for Sure Buying your first home is exciting—but it’s also a major financial decision. So how can you tell if you’re truly ready to take that leap into homeownership? Whether you’re confident or still unsure, these four signs are solid indicators that you’re on the right path: 1. You’ve Got Your Down Payment and Closing Costs in Place To purchase a home in Canada, you’ll need at least 5% of the purchase price as a down payment. In addition, plan for around 1.5% to 2% of the home’s value to cover closing costs like legal fees, insurance, and adjustments. If you’ve managed to save this on your own, that’s a great sign of financial discipline. If you're receiving help from a family member through a gifted down payment , that works too—as long as the paperwork is in order. Either way, having these funds ready shows you’re prepared for the upfront costs of homeownership. 2. Your Credit Profile Tells a Good Story Lenders want to know how you manage debt. Before they approve you for a mortgage, they’ll review your credit history. What they typically like to see: At least two active credit accounts (trade lines) , like a credit card or loan Each with a minimum limit of $2,000 Open and active for at least 2 years Even if your credit isn’t perfect, don’t panic. There may still be options, such as using a co-signer or working on a credit improvement plan with a mortgage expert. 3. Your Income Can Support Homeownership—Comfortably A steady income is essential, but not all income is treated equally. If you’re full-time and past probation , you’re in a strong position. If you’re self-employed, on contract, or rely on variable income like tips or commissions, you’ll generally need a two-year history to qualify. A general rule: housing costs (mortgage, taxes, utilities) should stay under 35% of your gross monthly income . That leaves plenty of room for other living expenses, savings, and—yes—some fun too. 4. You’ve Talked to a Mortgage Professional Let’s be real—there’s a lot of info out there about buying a home. Google searches and TikToks can only take you so far. If you're serious about buying, speaking with a mortgage professional is the most effective next step. Why? Because you'll: Get pre-approved (and know what price range you're working with) Understand your loan options and the qualification process Build a game plan that suits your timeline and financial goals The Bottom Line: Being “ready” to buy a home isn’t just about how much you want it—it’s about being financially prepared, credit-ready, and backed by expert advice. If you’re thinking about homeownership, let’s chat. I’d love to help you understand your options, crunch the numbers, and build a plan that gets you confidently across the finish line—keys in hand.

Fixed vs. Variable Rate Mortgages: Which One Fits Your Life? Whether you’re buying your first home, refinancing your current mortgage, or approaching renewal, one big decision stands in your way: fixed or variable rate? It’s a question many homeowners wrestle with—and the right answer depends on your goals, lifestyle, and risk tolerance. Let’s break down the key differences so you can move forward with confidence. Fixed Rate: Stability & Predictability A fixed-rate mortgage offers one major advantage: peace of mind . Your interest rate stays the same for the entire term—usually five years—regardless of what happens in the broader economy. Pros: Your monthly payment never changes during the term. Ideal if you value budgeting certainty. Shields you from rate increases. Cons: Fixed rates are usually higher than variable rates at the outset. Penalties for breaking your mortgage early can be steep , thanks to something called the Interest Rate Differential (IRD) —a complex and often costly formula used by lenders. In fact, IRD penalties have been known to reach up to 4.5% of your mortgage balance in some cases. That’s a lot to pay if you need to move, refinance, or restructure your mortgage before the end of your term. Variable Rate: Flexibility & Potential Savings With a variable-rate mortgage , your interest rate moves with the market—specifically, it adjusts based on changes to the lender’s prime rate. For example, if your mortgage is set at Prime minus 0.50% and prime is 6.00% , your rate would be 5.50% . If prime increases or decreases, your mortgage rate will change too. Pros: Typically starts out lower than a fixed rate. Penalties are simpler and smaller —usually just three months’ interest (often 2–2.5 mortgage payments). Historically, many Canadians have paid less overall interest with a variable mortgage. Cons: Your payment could increase if rates rise. Not ideal if rate fluctuations keep you up at night. The Penalty Factor: Why It Matters More Than You Think One of the biggest surprises for homeowners is the cost of breaking a mortgage early —something nearly 6 out of 10 Canadians do before their term ends. Fixed Rate = Unpredictable, potentially high penalty (IRD) Variable Rate = Predictable, usually lower penalty (3 months’ interest) Even if you don’t plan to break your mortgage, life happens—career changes, family needs, or new opportunities could shift your path. So, Which One is Best? There’s no one-size-fits-all answer. A fixed rate might be perfect for someone who wants stable budgeting and plans to stay put for years. A variable rate might work better for someone who’s financially flexible and open to market changes—or who may need to exit their mortgage early. Ultimately, the best mortgage is the one that fits your goals and your reality —not just what the bank recommends. Let's Find the Right Fit Choosing between fixed and variable isn’t just about numbers—it’s about understanding your needs, your future plans, and how much financial flexibility you want. Let’s sit down and walk through your options together. I’ll help you make an informed, confident choice—no guesswork required.

Nice things people have said about working with me.

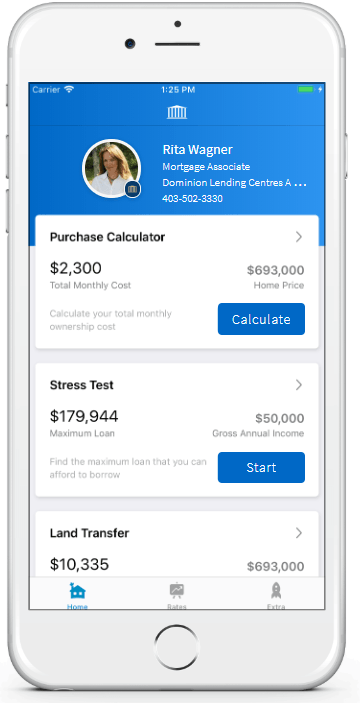

Let's Run Some Numbers

Download My Mortgage Toolbox

WHAT CAN YOU DO WITH MY APP

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese